During my audit days in Arthur Andersen I had a privilege to lead audit engagements in a few subsidiaries of international holdings and groups.

For me, it was very interesting and educative.

First of all I learned that the local management of these subsidiaries is often just a formal function and the real decisions are taken somewhere else.

This was exactly the case with the local subsidiary of a multinational group selling and servicing some equipment.

The local company was quite small and as we auditors like to say – its size represented a rounding error within the group (meaning it was so small that any error or misstatement in its account would be immaterial for the group).

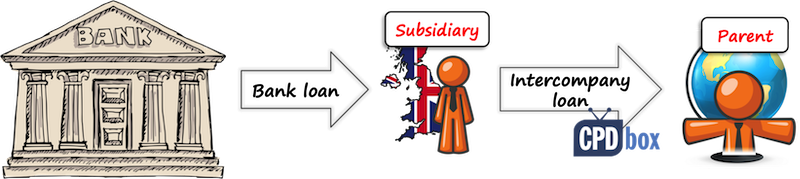

That’s why I was very surprised to see the huge loan they took from the local bank.

Why? Where did the cash go?

Oh, I spotted it instantly – there was a big receivable towards the parent company.

In other words, the parent company took the loan from our local bank via its subsidiary.

I asked for the documentation related to the loan provided to the parent.

There was literally nothing.

So I asked – but what is this receivable all about? What is the repayment date and schedule? Does it carry any interest?

All these questions are very important for two reasons:

I believe that the similar situation arises in many companies and in a great selection of various scenarios, for example:

…and many others.

Intercompany loans within the group are very frequent these days.

But, they bring a lot of troubles and issues, especially if there’s no documentation (contract), no fixed repayment date or schedule and no interest.

In today’s article, I would like to tackle a few questions related to intercompany loans.

This happens very often, especially between the parent and a subsidiary.

The parent just sends the cash without a single word (OK, in reality, the parent’s people tell you what it is for, but it’s nothing formal).

Here, we have one big problem:

Did the subsidiary receive a loan?

It can happen that the cash send from the parent to the subsidiary is not a loan at all.

If the parent explained that it would demand the repayment of that cash in the future, then it’s a liability in subsidiary’s accounts.

However, I had a different experience with one of my clients.

The client’s local branch was always loss-making and the parent always sent big cash to cover the loss with no further explanation after the year-end.

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

The subsidiary was loss making because of bad transfer pricing practices and the parent wanted to rectify the situation with cash transfers.

In this case, the substance of this cash transfer might be a capital contribution and NOT a loan.

Of course, this must be cross-checked with the local legislation, but in most cases, when the loan is NOT repayable at all, or repayable upon subsidiary’s decision, then it is NOT a loan, but capital.

So, the parent would record the loan as an investment in subsidiary and a subsidiary as equity.

Let’s say that you solved the issue n. 1 and said – no, it’s not equity, but it’s a loan.

But, the loan is at very low (or zero) interest.

Yes, that often happens within the group.

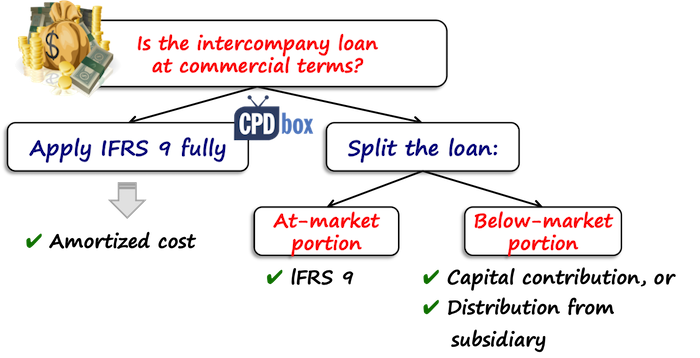

The loan might not be provided on normal commercial terms.

However, the standard IFRS 9 says that you should recognize a financial instrument initially at fair value.

The fair value of this loan is simply future cash flows from that loan discounted to the present value with market interest rate.

Now, that’s nice, but how would you treat the difference?

Let me show you.

Let’s say that the parent provided an interest-free loan of CU 100 000 to its subsidiary, the loan is repayable in 3 years and market interest rate is 5%.

The fair value of this loan is CU 86 384 (it is CU 100 000 in 3 years discounted to present value with the market rate of 5%).

There is a difference between the cash received of CU 100 000 and the fair value of the loan of CU 86 384 amounting to CU 13 616.

How should the subsidiary and the parent recognize this difference?

Normally, when the companies are not within the same group, this difference is recognized in profit or loss (exceptions exist).

However, this time, we are dealing with the capital contribution from a parent to the subsidiary, because interest-free loan would never happen without the related party relationship.

So, the parent recognizes the loan initially as:

The subsidiary’s entry is very similar:

If the loan is provided in the opposite direction (by subsidiary to parent), then analogically, the “below-market” component is recognized as a distribution from subsidiary.

I received the same question a few times.

How should you classify the intercompany loan if it bears no interest?

The answer is – at amortized cost.

The reason is that the interest-free intercompany loan still meets both conditions for amortized cost classification:

If we look at the loan from the above example, then subsequently, you need to remeasure the loan at its amortized cost by charging an interest (assuming there’s no repayment in the first year).

The journal entry in parent’s books is:

The trouble with all financial assets at amortized cost is that the parent needs to recognize an impairment loss.

Under the newest IFRS 9 requirements, we need to apply general 3-stage model to all loans (no exception).

It makes it quite complicated, because the parent now needs to calculate 12-month expected credit loss on the loan to subsidiary if it is in stage 1 (no deteriorated credit risk).

And, it needs to estimate the probability of subsidiary’s default within the next 12 months.

This also happens very often.

Either the loan is somehow documented in the contract, but the repayment date is missing, or there’s no documentation at all and you have no idea what the repayment date is.

In this case, I would kindly advice to go through any available communication or documentation, like minutes from the board of directors.

If it does not help, then the management of a subsidiary should express their best estimates and assessment of the loan repayment, in order to set the loan’s fair value and present it correctly.

The best thing would be seeking guidance from the parent, of course.

The management should mainly assess if the loan could be repayable on demand.

Believe me, this is a very probable scenario and I’ve seen this in practice a lot – if the parent does not explicitly says about the repayment and it is NOT a capital contribution, then you have no choice but to see the loan as repayable on demand.

It means that you would classify the loan as a current liability.

The advantage of this approach is that you don’t have to discount anything (as the “loan” is short-term).

Special For You! Have you already checked out the IFRS Kit ? It’s a full IFRS learning package with more than 40 hours of private video tutorials, more than 140 IFRS case studies solved in Excel, more than 180 pages of handouts and many bonuses included. If you take action today and subscribe to the IFRS Kit, you’ll get it at discount! Click here to check it out!

On the other hand, the big disadvantage is that the financial rations like liquidity immediately worsen, because the current liabilities would rock to the sky.

If the loan is not repayable on demand, then:

I have described the mechanics of accounting for below-market interest rates in this article, so please check that out if interested.

Unfortunately, there is no specific IFRS guidance on how to treat intercompany loans, so we need to use what we have.

I have tried to help a bit in this article, but I know very well that every single loan is different, provided at different circumstances and indeed, you should carefully assess every single aspect of it.

Also, I would like to stress that as intercompany loans ARE an intragroup transaction with related parties, you will have to include the number of disclosures in line with IAS 24 to your financial statements.